W4 calculator 2020

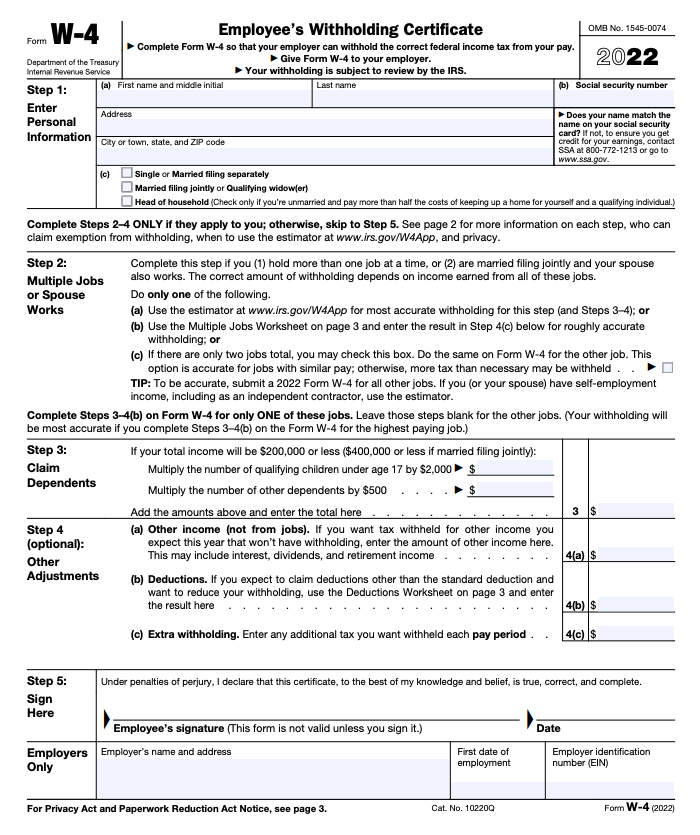

Free 2022 Employee Payroll Deductions Calculator W-4 with Exemptions Use this calculator to help you determine the your net paycheck. To keep your same tax withholding amount.

2020 W4 Withholding Form Sunrise Hcm

Our free W4 calculator allows you to enter your tax information and adjust your paycheck.

. W4 Calculator 2022. Submit or give Form W-4 to your employer. 250 minus 200 50.

Recommended for planning the future based on the past. Ask your employer if they use an automated system to submit Form W-4. Any results this calculator.

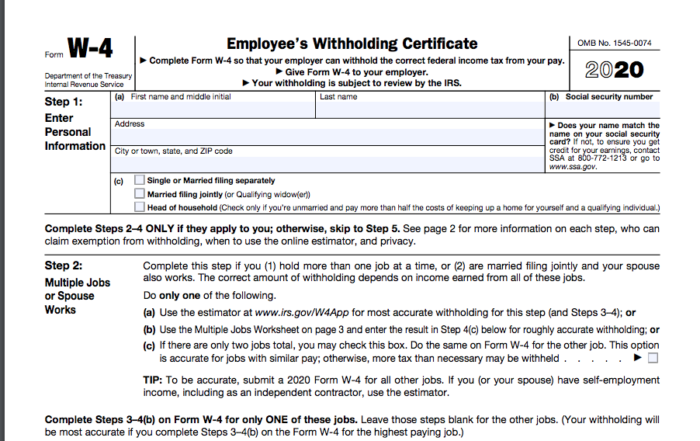

For example if an employee earns. This calculator uses the old W-4 created before. Federal Form W4 Wizard.

Thats where our paycheck calculator comes in. HR Block does not provide audit attest or. Median household income in 2020 was 67340.

The Form W4 Withholding wizard takes you through each step of completing the Form W4. IRS tax forms. If the return is not complete by 531 a 99 fee for federal and 45 per state return will be applied.

You can use the Tax Withholding. Up to 10 cash back Maximize your refund with TaxActs Refund Booster. Adjust a previously created W-4 based on your 2020 Tax Return or 2021 Tax Return results in 2022.

The 2020 Tax Calculator uses the 2020 Federal Tax Tables and 2020 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators. 250 and subtract the refund adjust amount from that. That result is the tax withholding amount.

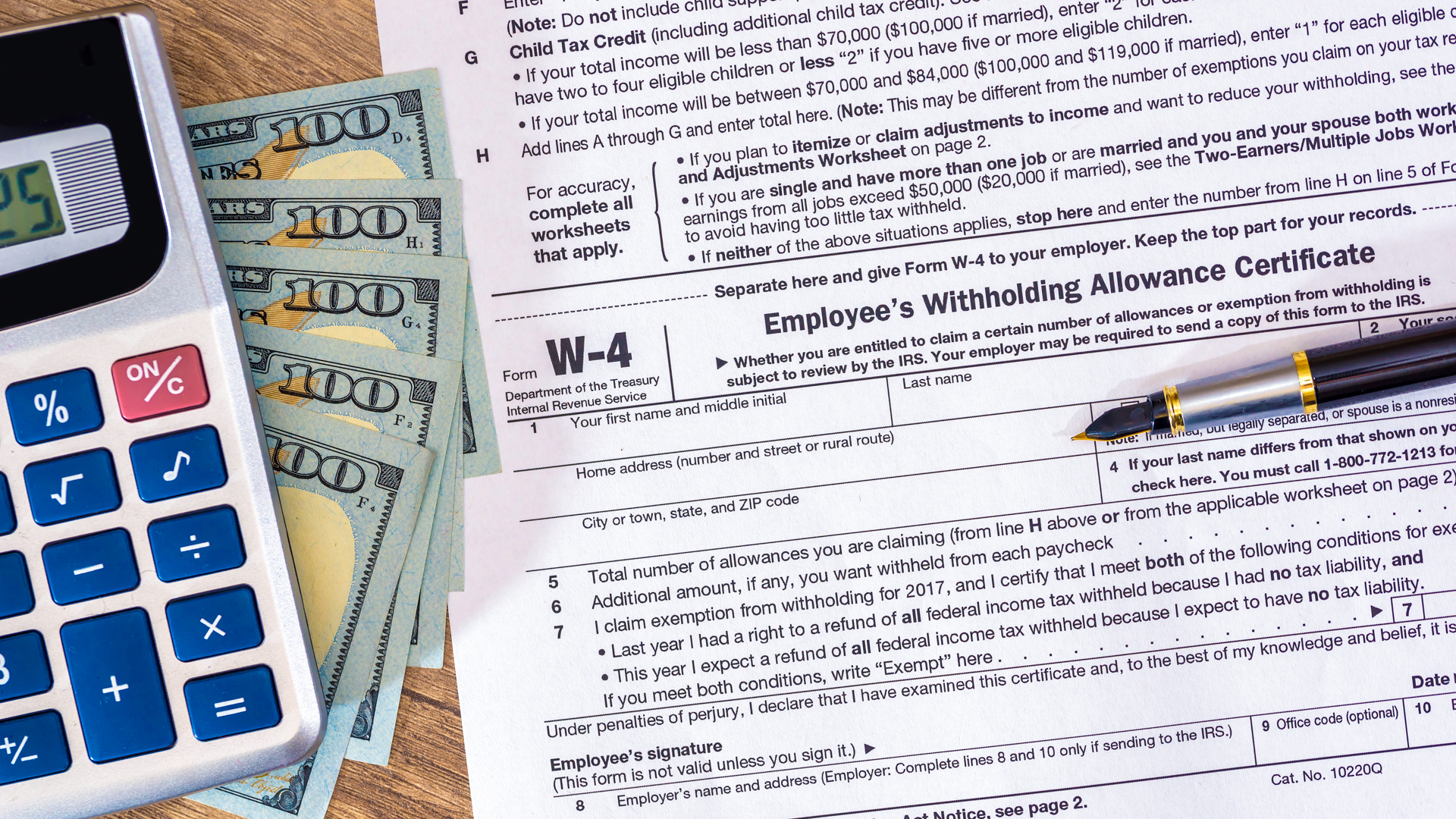

Tax withholding is the money that comes out of your paycheck in order. The Form W4 provides your employer with the details. This will give you an idea of whether.

Were about to look at the need-to-know for the W-4 form and provide you with our W-4 calculator so you can make sure youre on the right path. For help with your withholding you may use the Tax Withholding Estimator. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Then look at your last paychecks tax withholding amount eg. How to calculate annual income. Offer valid for returns filed 512020 - 5312020.

Since early 2020 any change made to state withholding must be made on Form OR-W-4 as the new federal Form W-4 cant be used for Oregon withholding purposes. Or Select a state. W4 Calculator for calculating how much federal income tax youre going to withhold during the course of the tax year.

The information you give your employer on Form W4.

Irs Improves Online Tax Withholding Calculator

W 2 And W 4 What They Are And When To Use Them Bench Accounting

A New Form W 4 For 2020 Alloy Silverstein

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

W 4 Form What It Is How To Fill It Out Nerdwallet

How To Fill Out A W 4 A Complete Guide Gobankingrates

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

Federal And State W 4 Rules

The New Form W 4 Form Is Different Really Different Asap Accounting Payroll

How To Calculate Federal Income Tax

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Tax Withholding Estimator New Free 2019 2020 Irs Youtube

W 4 Form Basics Changes How To Fill One Out

Tax Withholding Calculator 2022 Federal Income Tax Zrivo

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Mobile Farmware Irs Form W 4 2020